Businesses and corporations have another tax incentive available to them: bonus depreciation! Renewable projects are generally depreciated on a five year schedule under the Modified Accelerated Cost-Recovery System (MACRS). However, starting in 2013, business entities can depreciate 50% of their project costs first year, with the balance being divided over the remaining four. This incentive, coupled with the investment tax credit or production tax credit, provides businesses with yet another way to make their return on investment more lucrative. For more information on accelerated depreciation, click on this link: www.dsireusa.org or call (217) 825-4206 to speak with a WindSolarUSA, Inc. professional!

In addition, for certain other types of renewable energy property, such as biomass or marine and hydrokinetic property, the MACRS property class life is seven years. Eligible biomass property generally includes assets used in the conversion of biomass to heat or to a solid, liquid or gaseous fuel, and to equipment and structures used to receive, handle, collect and process biomass in a waterwall, combustion system, or refuse-derived fuel system to create hot water, gas, steam and electricity. Marine and hydrokinetic property includes facilities that utilize waves, tides, currents, free-flowing water, or differentials in ocean temperature to generate energy. It does not include traditional hydropower that uses dams, diversionary structures, or impoundments.

The 5-year schedule for most types of solar, geothermal, and wind property has been in place since 1986. The federal Energy Policy Act of 2005(EPAct 2005) classified fuel cells, microturbines and solar hybrid lighting technologies as five-year property as well by adding them to § 48(a)(3)(A). This section was further expanded in October 2008 by the addition of geothermal heat pumps, combined heat and power, and small wind under The Energy Improvement and Extension Act of 2008.

Bonus depreciation has been sporadically available at different levels during different years. Most recently, the Tax Cuts and Jobs Act of 2017 increased bonus depreciation to 100% for qualified property acquired and placed in service after September 27, 2017 and before January 1, 2023.

For more information on accelerated depreciation, click on this link or call (217) 825-4206 to speak with a WindSolarUSA, Inc. professional!

Bringing affordable solar, utilizing American-made products, to all of Illinois

Click here

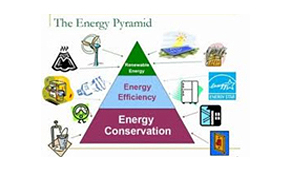

The first step to any renewable energy project is energy efficiency. New advances in the energy management

Read more

WindSolarUSA, Inc. works with distributors and manufacturers to be able to offer you

Read more

If you can imagine it, we can design it. From flush mounted residential roof mounts, to expansive commercial

Read more

WindSolarUSA, Inc. offers consulting services that can benefit individuals, companies, municipalities,civic

Read more

Are you interested in learning more about renewable energy for your home, business or farm? Take advantage

Read more

Free, no-obligation site visits are included to help you decide if solar is right for you! Want to ensure you have

Read more

Our staff handles all of your permitting and utility applications, renewable energy credit processing

Read more